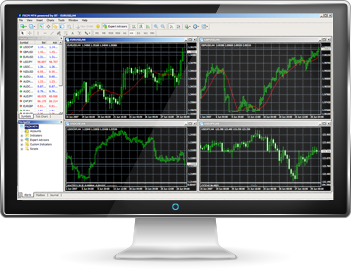

MetaTrader 4 (MT4) remains one of the most popular trading platforms among forex traders worldwide. One of its standout features is its comprehensive charting capabilities, which provide traders with the insights needed to make informed decisions. In this article, we’ll explore the essentials of understanding metatrader 4 for windows charts, ensuring you’re well-equipped to utilize them effectively in your trading endeavors.

Types of Charts in MetaTrader 4

MT4 offers three main types of charts: Line Charts, Bar Charts, and Candlestick Charts. Each type has its own unique advantages and can be chosen based on your trading strategy and personal preference.

1. Line Charts: These charts connect the closing prices of each time period with a continuous line. They are simple to read and are ideal for identifying the overall direction of the market. However, they do not provide as much detail as other chart types.

2. Bar Charts: Bar charts offer more detail by displaying the open, high, low, and close prices for each time period. Each bar represents a single time period, making it easier to identify trends and potential reversals.

3. Candlestick Charts: Perhaps the most popular among traders, candlestick charts provide the same information as bar charts but in a more visually intuitive format. Candlesticks are color-coded to indicate bullish or bearish trends, making it easier to spot patterns and make quick trading decisions.

Key Elements of MT4 Charts

Understanding the key elements of MT4 charts is crucial for effective analysis. Here are some of the most important components:

1. Timeframes: MT4 allows you to choose from various timeframes, ranging from one minute to one month. Selecting the right timeframe depends on your trading style; short-term traders might prefer 1-minute or 5-minute charts, while long-term traders often use daily or weekly charts.

2. Indicators: MT4 offers a wide range of technical indicators that can be overlaid on charts to enhance your analysis. Popular indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands. These tools help traders identify trends, potential entry and exit points, and market volatility.

3. Chart Customization: MT4 provides extensive customization options, allowing you to tailor charts to your preferences. You can change colors, add or remove grid lines, and customize the appearance of candlesticks or bars, making it easier to read and interpret the data.

Conclusion

Mastering the use of MetaTrader 4 charts is essential for any serious trader. By understanding the different types of charts, the key elements, and how to customize them, you can gain valuable insights and improve your trading decisions. Whether you’re a novice trader or an experienced professional, taking the time to familiarize yourself with MT4’s charting capabilities will undoubtedly enhance your trading performance.